In the annual report below, we look at The Chapman Consulting Group’s HR searches conducted in the year from 1 July 2009 until 31 July 2010. The statistics contained in this report are compiled from the advertisements put on our website. This totalled 227 HR jobs versus 191 HR jobs in 2008/2009. The analysis on our searches cover the breakdown of HR specialisations, industries, locations, job types, travel frequencies, locations of the global headquarters, global turnover of companies, geographic coverage of the roles, and finally the level and position of the hiring managers.

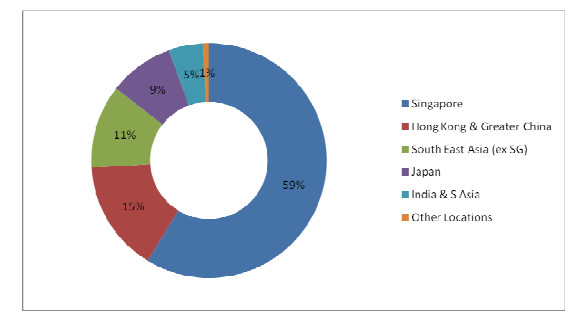

Location

With The Chapman Consulting Group being regionally headquartered in Singapore it is not surprising that 59% of our senior HR searches were for roles located in Singapore in the 2009/2010 year (as opposed to 63% in the 2008/2009 year). 15% of HR searches were based in Greater China (China and Hong Kong) and we expect this figure to rise significantly in the 2010/2011 as we dedicate greater focus to this region. South East Asia (being Thailand, Malaysia, Indonesia, Vietnam and the Philippines) made up 11% of our HR searches. Japan makes up 9% of our senior HR searches in 2009/2010 and was the second biggest single market after Singapore. India constituted 5% of our HR searches, although we spent a significant amount of time talking with Indian HR talent as we move the best and brightest into other parts of the region.

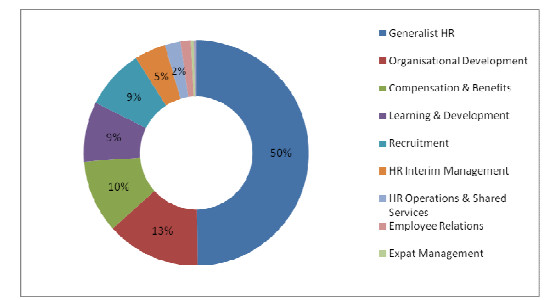

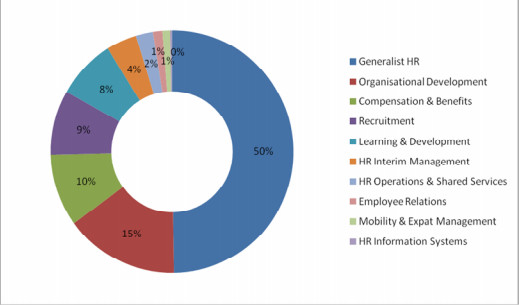

Job Function

Similar to our 2008/2009 results, our 2009/2010 analysis shows 50% of our HR searches were concentrated in the HR Generalist and Business Partnering space (versus 49% a year earlier). Organisational Development searches grew slightly to 13% from 11% a year earlier. Compensation & Benefits searches grew from 8% to 10%. Learning & Development searches made up 9% of the total versus 8% a year earlier. Recruitment/Staffing searches grew 1 point from 8% to 9%. HR Interim Management opportunities swelled to 8% from 5% from our total. HR Operations, Shared Services and HRIS searches were down from 7% in 2008/2009 to 2% of the total this year.

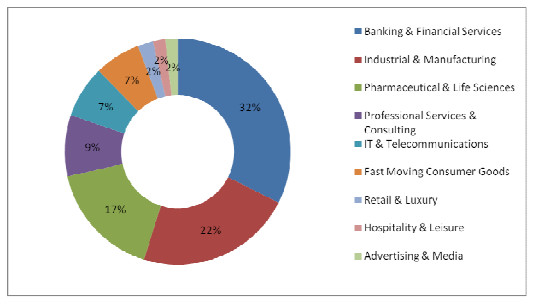

Industry

​A continued goal of The Chapman Consulting Group has been to remain as diversified as possible from an industry coverage perspective. We like to know each individual industry space well (particularly banking and financial services) but we recognise that the best HR talent is moveable across industries. We liked to keep the broadest spread of relationships possible.

The Banking and Financial Services was up 1 point to 32% from 31%. The Industrial and Manufacturing sector was up 5 points to 22%. The Pharmaceutical and Life Sciences sector grew 7 points from 10% to 17% of our focus. This reflects the relative buoyancy of the healthcare industries in the region. Professional Services was down from 13% to 9%. IT/Telecommunications fell 9 points from 16% to 9%. Fast Moving Consumer Goods grew from 6% to 7%.

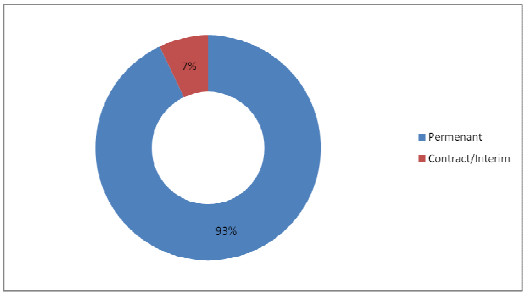

Job Type

​93% of the HR hires that The Chapman Consulting Group was involved in during the 2009/2010 year were permanent appointment hires. Interim hires made up 7% of the total, up two points from the 2008/2009 year. Organisations in Singapore and Hong Kong are beginning to embrace the concept of interim talent hires. This has been particularly the case in the Banking and Financial Services space, which has seen the greatest number of contractors added. Looking across the region, Australia and New Zealand remain the two most popular countries where we are seeing HR contractors being used.

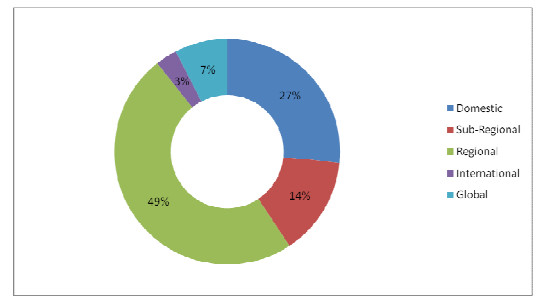

Geographic Coverage of the Role

​Being based in a regional headquarter setting, it is natural that of the 227 searches performed by The Chapman Consulting Group in 2009/2010, 49% of them had a fully regional remit. 14% of our searches had a sub regional remit (Greater China, North Asia, South Asia and South East Asia being some of these). 3% of our searches had an international remit (Asia Pacific and beyond) and 7% had a global remit. 27% of our searches were focused at a country level only.

These figures remained relatively constant with those in 2008/2009, with regional searches growing by 7 points, sub regional HR searches losing 4 points, international HR searches losing 2 points, global HR searches remaining constant, and domestic searches falling 1 point. We are confident of an emerging trend of international and sometimes global HR positions being moved to Asia. We predicted this trend last year and think that it will start to become more visible over the next three to five years. Asia, as a key growth location in the world, will become an important local for key global talent.

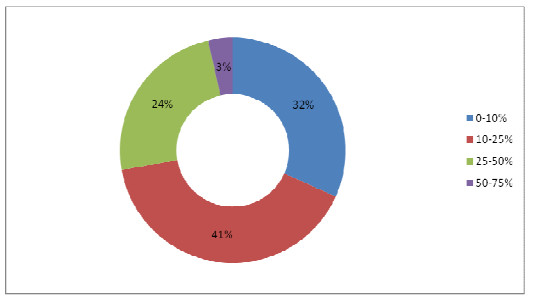

Travel Frequency of Roles

Travel is a necessary part of most regional and international roles, and often country roles. Of the 227 HR searches that The Chapman Consulting Group opened in the 2009/2010 year, 32% had less than 10% travel in an average month. 41% had between 10% and 25% travel. At least 24% of jobs that travel of between 25% and 50%. Just 3% of jobs had expected travel of more than 50%.

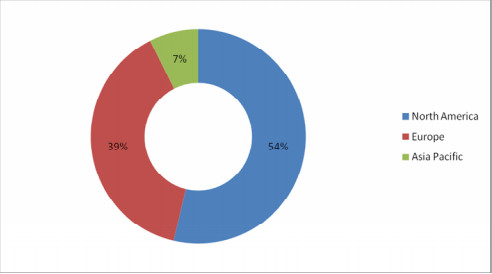

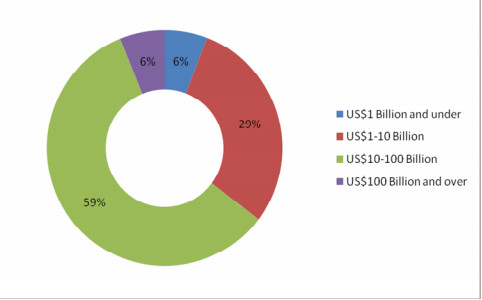

Location of Global Headquarters and Annual Turnover

​48% of our HR searches in 2009/2010 were with North America-based companies, down dramatically from 2008/2009 where this figure was 68%. European headquartered companies now make up 42% of our HR searches relative to 26% the year before. Around 10% of our HR searches are now with Asia Pacific headquartered companies. Around 52% of our searches are with companies with a US$10 billion+ turnover with the remaining 48% being with organisations with a turnover of less than US$10 billion.

Hiring Manager

​Our HR searches tend to come through three channels — Regional HR Heads or Specialists, Regional CEOs (or Business Leaders) and Global HR Heads or Specialists. In the year of 2009/2010, 51% of our searches came from the Regional HR Head and 11% of our searches came from a Regional HR Specialist. A total of 23% of our searches came via way of the Global HR Head or Global HR Specialist. This growth in Global HR Heads of Specialists being a source of our key HR searches in Asia is dramatic, up from 11% the year before. Searches coming from Country Heads of HR or Country Specialist leads across the region represent less than 10% of our business.

Andrea Merrigan

Andrea Merrigan Orelia Chan

Orelia Chan Stanislav Medvedev

Stanislav Medvedev Fleur Daniell

Fleur Daniell Finian Toh

Finian Toh Tim Rayner

Tim Rayner Nicola Hasling

Nicola Hasling Stefanie Cross-Wilson

Stefanie Cross-Wilson